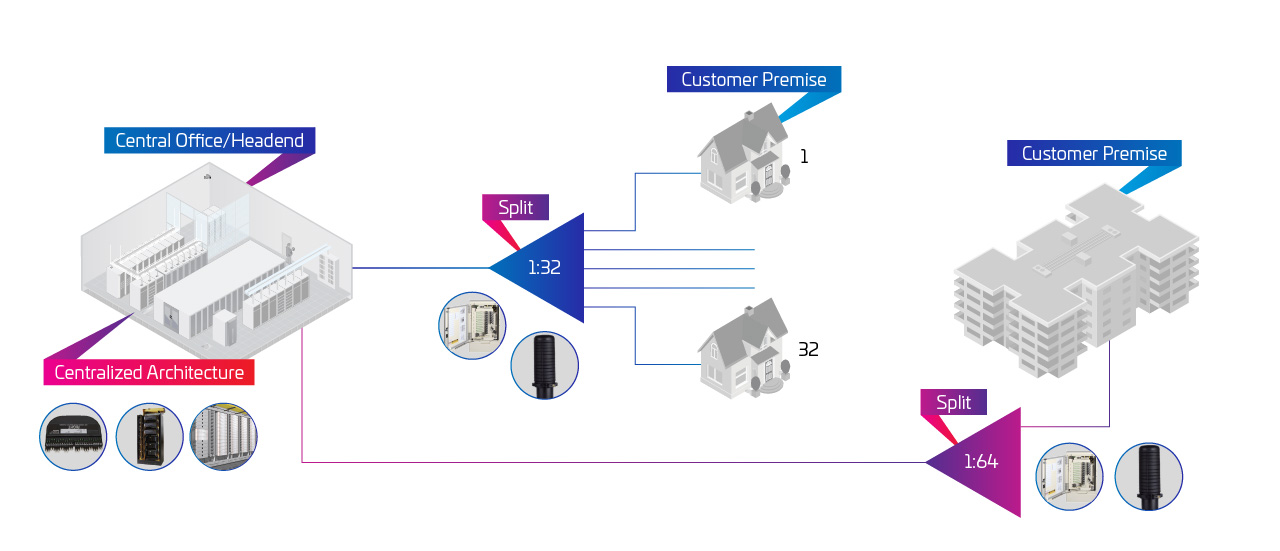

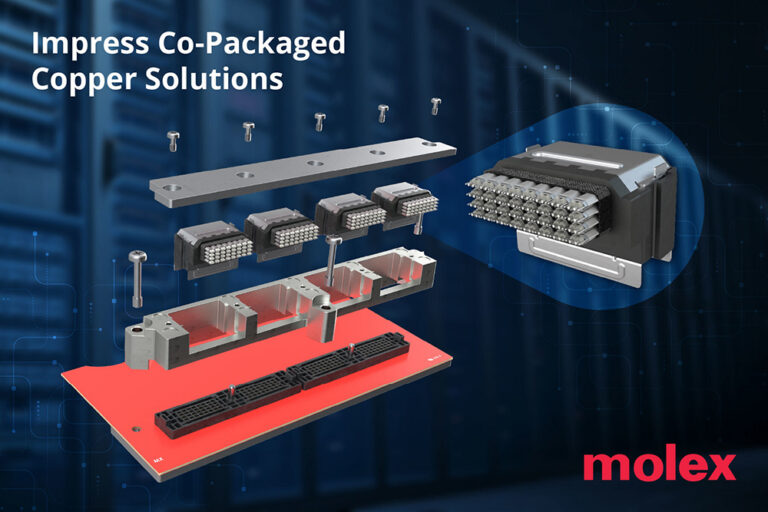

CCS comprises three primary segments: Data Center Connectivity Solutions, offering fiber optic interconnects for IT datacom and data center customers; Broadband Communications, focused on interconnect solutions for communications networks; and Building Connectivity Solutions, supplying a range of interconnect products for industrial and smart building infrastructure. Amphenol reports that assuming stable economic conditions, CCS is expected to generate approximately $3.6 billion in sales with EBITDA margins of about 26 percent in calendar year 2025. The company expects the acquisition to be accretive to its diluted earnings per share in the first full year after closing, not including acquisition-related expenses.

According to Amphenol President and Chief Executive Officer R. Adam Norwitt, “CCS is a premier and iconic business with a wide array of innovative fiber optic and other interconnect technology and product capabilities, as well as a broad IP portfolio that is supported by the business’s robust research and development capabilities. In particular, CCS’s broad portfolio of fiber optic interconnect solutions for the rapidly growing IT datacom market, including for artificial intelligence applications, is highly complementary to Amphenol’s already strong product offerings in this market.” Norwitt further noted the acquisition adds fiber optic competencies for communications networks and expands capabilities for industrial and building infrastructure connectivity solutions.

Amphenol plans to finance the acquisition using a mix of cash and debt, and has secured financing commitments from J.P. Morgan Securities, BNP Paribas, and Mizuho Bank. The completion of the transaction is expected in the first half of 2026, subject to regulatory approvals and customary closing conditions.

Source: Amphenol