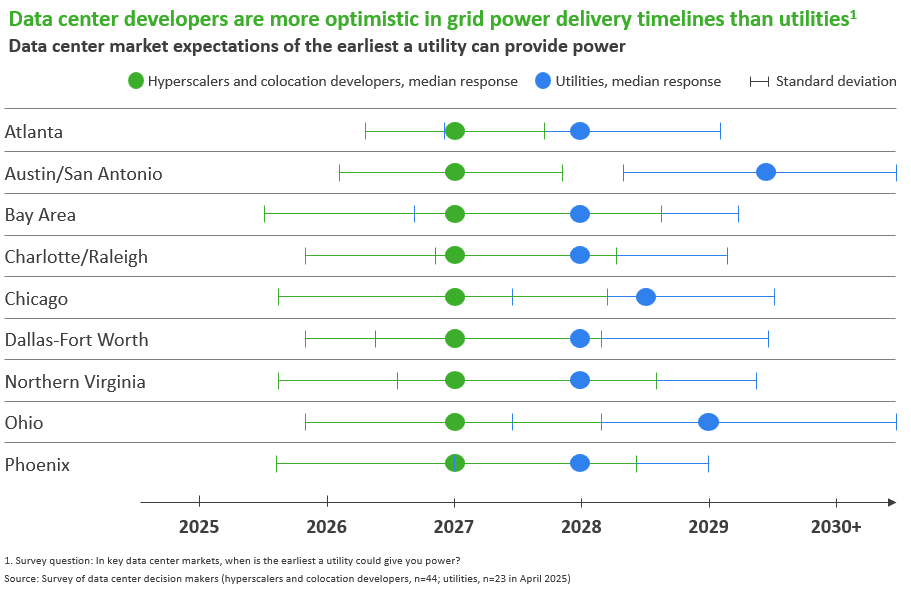

The report found that timeframes for securing electricity connections from utilities in key US markets exceed operator expectations by up to two years, forcing many operators to reconsider deployment timelines and power sourcing strategies. Consequently, 84% of respondents ranked electricity availability among their top three considerations when selecting data center locations.

Operators increasingly plan to address these challenges by adopting onsite generation solutions. By 2030, 38% of data center facilities anticipate using onsite generation as a primary power source—up dramatically from 13% the previous year. Additionally, the percentage of facilities expecting to be entirely powered by onsite generation by 2030 rose to 27%, up from just 1% previously.

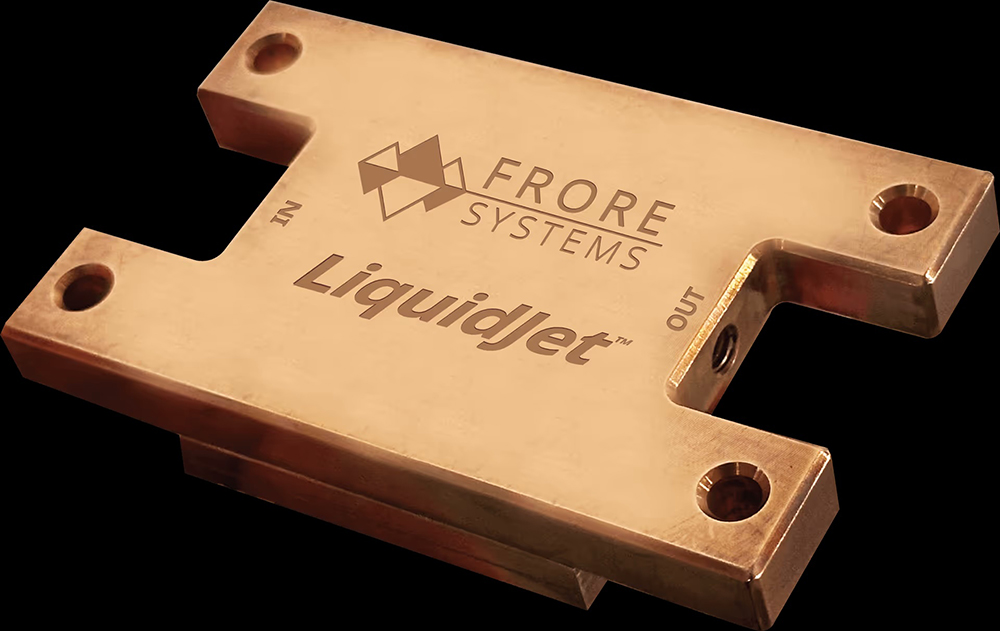

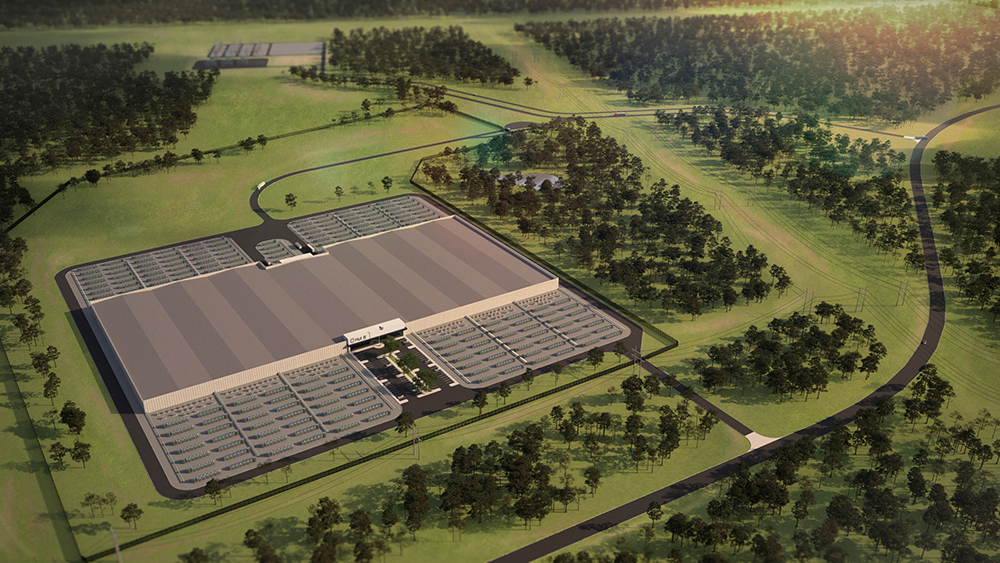

Bloom Energy also noted that AI-driven data center growth significantly increases power demands and facility size, with median data center capacities projected to grow nearly 115% over the next decade—from approximately 175 MW currently to about 375 MW.

“Decisions around where data centers get built have shifted dramatically over the last six months, with access to power now playing the most significant role in location scouting,” said Aman Joshi, Chief Commercial Officer at Bloom Energy. “The grid can’t keep pace with AI demands, so the industry is taking control with onsite power generation. When you control your power, you control your timeline, and immediate access to energy is what separates viable projects from stalled ones.”

The survey respondents indicated sustainability targets remain a priority, with 95% committed to carbon reduction initiatives despite the ongoing power availability challenges.

Source: Bloom Energy