Supermicro has announced new STAC-M3 benchmark records for its Petascale X14 Series all-flash storage servers using Intel Xeon 6 processors, Micron 9550 NVMe SSDs, DDR5 memory, and the KX Software kdb+ database. The results, reported at the STAC Summit in New York City, are based on independent benchmarking conducted by the Securities Technology Analysis Center (STAC) and demonstrate significant reductions in query latency and improvements in throughput for workloads critical to algorithmic trading and data-intensive financial analytics.

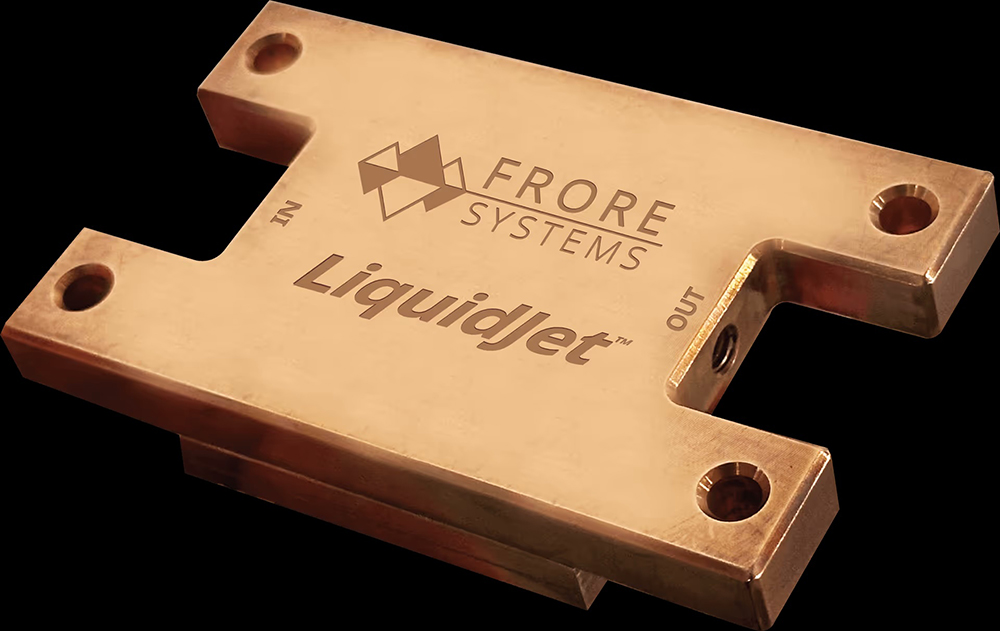

The tested configuration consisted of six Supermicro SSG-222B-NE3X24R Petascale 2U servers (12U total rack space) with dual Intel Xeon 6767P CPUs (64 cores, 128 threads per server, 3.9 GHz max turbo, 350W TDP), 16 Micron 128 GB DDR5 RDIMMs per server (2.048 TB at 6400 MT/s), and 24 Micron 9550 12.8 TB NVMe SSDs per server. KX Software’s kdb+ 4.1 database—optimized for real-time and historical data—was deployed to support demanding time-series workloads. This setup delivered 1.6 pebibytes (PiB) of performance-optimized all-flash storage capacity within one-quarter to one-half the rack space of previous record-holders.

The STAC-M3 benchmark addresses high-frequency trading scenarios by simulating real-time quantitative trading with bid-ask and trade data for thousands of assets. It evaluates compute, storage, networking, and software performance in multi-user environments and is widely used in banks, hedge funds, trading exchanges, and quantitative finance shops. The benchmark features two test sets: Antuco (smaller datasets) and Kanaga (20 times larger datasets with more concurrent users).

According to the official STAC-M3 results, the Supermicro-Intel-Micron-KX configuration set new world records in 19 out of 24 Kanaga mean-time response benchmarks—including all Kanaga 50 and 100 user scenarios—and three of five Kanaga throughput tests. In Antuco testing, all three 50 and 100 user benchmarks reached new highs. The 100-user unpredictable interval statistics benchmark was completed 36% faster than prior records while using 62% fewer CPU cores, as Supermicro reports.

Srini Krishna, Intel Fellow and Head of Data Center Products, provided technical commentary: “In high-frequency trading and analytics, managing large data volumes, maintaining deterministic low latency, and handling complex processing are vital. Financial firms must analyze billions of tick data points per day to respond to market changes, optimize profits, and manage risk effectively. Today’s STAC-M3 results show Intel Xeon 6 delivering record-setting performance and efficiency—helping trading teams act faster, capture alpha, and assess risk with confidence.”

Alvaro Toledo, vice president and general manager for the Americas Core Data Center Business Unit at Micron, added: “When trading securities in a rapidly moving market, microseconds can mean millions of dollars, making speed the ultimate currency. In audited STAC-M3 testing, Micron 9550 NVMe SSDs and DDR5 RDIMMs delivered exceptionally low, predictable latency under heavy I/O and compute-bound operations, turning tick data into insights faster than ever.”

Comprehensive benchmark details are available on the STAC website.

Source: Supermicro